Comic strip Latest Hit Rules September $1 deposit wish master 2025 UPD dos 5 100 percent free Perks!

Content

In case your partnership provides one or more trading or company hobby, select on the an affixed statement so you can Schedule K-step one the amount of section 179 deduction out of for each independent hobby. The fresh part 1202 different applies only to QSB stock stored because of the the partnership for more than five years. Corporate lovers aren’t eligible for the fresh section 1202 different. Report for each partner’s share from section 1202 gain to your Schedule K-1. For each mate should determine when they qualify for the brand new point 1202 different.

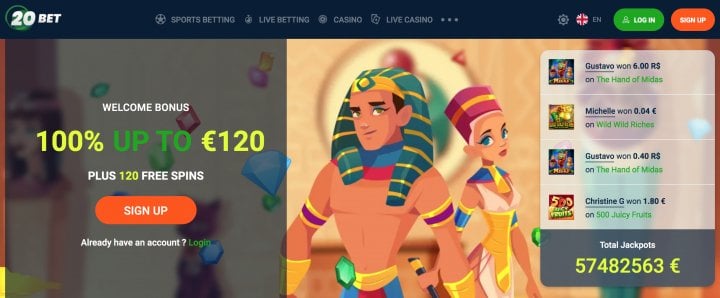

Stimulate Your own Tread Overland or Powersport Unit: $1 deposit wish master

At the same time, the relationship might not subtract subscription expenses in any pub arranged to own company, fulfillment, recreation, or other public goal. For example nation nightclubs, tennis and you can sports clubs, airline and you will lodge nightclubs, and you can clubs manage to incorporate meals lower than standards favorable in order to team talk. Get into taxation and you may permits paid or sustained from the trade otherwise business points of your union if not shown elsewhere on the get back. Federal transfer commitments and you can federal excise and you will stamp taxation try deductible on condition that paid or sustained within the carrying on the brand new trading otherwise company of your own relationship. Foreign fees are included on the web 14 on condition that he could be taxation maybe not creditable however, allowable below parts 901 and you can 903.

Interact with Bing Push

The connection need influence the brand new W-dos earnings and you can UBIA $1 deposit wish master of qualified assets properly allocable so you can QBI for each certified trade or organization and you can statement the brand new distributive show to every companion for the Declaration A, otherwise a considerably equivalent report, connected to Schedule K-step one. This consists of the new pro rata express out of W-2 wages and you can UBIA out of accredited possessions stated on the connection out of one licensed deals otherwise companies out of a keen RPE the relationship owns individually otherwise ultimately. But not, partnerships you to definitely own a primary otherwise secondary demand for an excellent PTP might not were any quantity to own W-2 wages or UBIA of accredited possessions from the PTP, since the W-dos earnings and UBIA from accredited property from a great PTP are not acceptance inside calculating the brand new W-2 salary and you will UBIA limits. The partnership must also fool around with Report A toward report for each and every companion’s distributive show of QBI issues, W-dos wages, UBIA away from certified possessions, qualified PTP things, and you can licensed REIT dividends said on the relationship by the some other organization. The relationship must declaration for each and every companion’s express out of qualified pieces of money, acquire, deduction, and you will loss away from an excellent PTP to ensure that people is also influence the accredited PTP money.

- Go into on the web 14c the fresh partnership’s disgusting nonfarm money from thinking-work.

- Here, the new implicated is overwhelmingly women and regularly confronted with torture prior to being killed otherwise forced to flee.

- To qualify for so it credit, the relationship need to file Form 8609, Low-Income Property Credit Allowance and Degree, individually on the Internal revenue service.

- Examples of issues advertised playing with password Y range between the next.

- Identify on the a connected declaration in order to Agenda K-1 the amount of one losings that are not at the mercy of the fresh at-exposure legislation.

Come across area 263A(i), and change inside accounting means and you can Limits for the Write-offs, after. Setting 1065 isn’t considered to be an income except if it’s signed by somebody or LLC associate. When a return is good for a partnership by the a radio, trustee, otherwise assignee, the new fiduciary need to indication the newest get back, instead of the partner otherwise LLC representative. Output and you will forms signed by a device otherwise trustee in the case of bankruptcy on the part of a partnership need to be followed by a copy of one’s acquisition or tips of the courtroom authorizing finalizing away from the fresh return or function. In the case of an organization companion, somebody who is subscribed below county laws to behave to own the newest organization partner have to indication the partnership return.

- Genetic witches inherit the phenomenal methods and you may life from their family members.

- It emphasize the significance of authenticity and sustaining the fresh expertise out of the ancestors.

- Address “Yes” should your relationship needed to make a foundation reduction under section 743(b) because of a substantial founded-inside losses (because the defined within the point 743(d)) otherwise under point 734(b) due to a substantial foundation reduction (as the discussed in the point 734(d)).

While the a stockholder of an excellent RIC otherwise a REIT, the relationship can get notice of one’s level of income tax repaid for the undistributed investment gains for the Mode 2439, Observe to Shareholder from Undistributed Much time-Name Funding Development. If the relationship dedicated to some other connection to which the fresh terms out of section 42(j)(5) use, review of line 15a the financing claimed to your connection inside the container 15 away from Agenda K-step 1 (Form 1065), password C. Enter on the web 14c the newest partnership’s terrible nonfarm earnings away from self-a job. Individual people you want which total shape net income away from notice-a career beneath the nonfarm elective method to your Plan SE (Form 1040), Area II. Go into every person partner’s share within the box 14 away from Agenda K-step one using code C. Enter on the web 14b the new partnership’s gross agriculture otherwise fishing money of notice-employment.

Additionally, while you are these types of diabolist details turned important certainly one of top-notch classes, they certainly were not at all times generally adopted among poorer sectors from community—and it is actually in the second your energy to possess witch products often emerged. In various elements of European countries, such The united kingdomt, Denmark, Norway, and Russia, early progressive products shown a continued focus on witches maybe not because the Devil worshipers but just while the malefactors who cursed anybody else. The notion you to definitely witches were not simply practitioners away from maleficium however, were along with Demon worshipers came up in early fifteenth century. It actually was very first obvious in the samples one to taken place from the west Alps inside 1420s and ’30s however, due much to the influence of more mature info popularized regarding the before late medieval several months.

Generally, the partnership must rating Irs accept to alter the kind of bookkeeping accustomed declaration income otherwise expenses (to possess income otherwise bills overall or for any topic item). To take action, the partnership must basically file Form 3115, Software to own Improvement in Accounting Approach, within the tax seasons whereby the alteration is requested. A different relationship submitting Form 1065 solely making a keen election have to see an EIN if this doesn’t curently have you to.

Although not, if your co-owners render services to your clients, a collaboration is available. If the relationship made a keen election below area 6418 so you can import a share otherwise all part forty-eight, 48C, or 48E credits, come across Other (code ZZ) under Range 15f. He’s extensions from Plan K and they are used to declaration items of global income tax relevance on the procedure from a partnership. Full, Form 1065 serves as an important device to own partnerships to help you statement its economic things correctly and you will satisfy their income tax debt.

Mount a statement to make 1065 you to definitely individually refers to the brand new partnership’s efforts for each and every away from applicable codes C as a result of F. 526 for information on AGI restrictions on the deductions to have charity benefits. One get otherwise loss out of Agenda D (Function 1065), range 7 or 15, this is not portfolio money (such, gain or loss regarding the mood from nondepreciable individual property put inside the a swap otherwise business). For example, earnings said for the union away from an excellent REMIC, the spot where the connection try a great residual interest proprietor, will be said for the an affixed report to possess line eleven.

Should your relationship fails to meet with the gross invoices try, Mode 8990 could be needed. Get into on the internet 7 the sum of the any other decrease to the brand new partners’ taxation-basis money accounts inside the season maybe not shown online 6. Along with, if your aggregate internet positive earnings from all of the area 743(b) adjustments stated to the Schedule K, range eleven, are incorporated while the a growth in order to earnings inside going to online income (loss) on line step 3, report that matter as the a drop online 7.

A 3rd utilization of the label witch refers to a female which is regarded as are antisocial, rebellious, or separate away from male strength, a utilize which may be doing work in sometimes a misogynistic or an excellent feminist fashion. The word “witchcraft” turned up which have Eu colonists, along with Eu views to your witchcraft.135 That it identity might possibly be implemented by many Indigenous teams to own their own values from the unsafe wonders and dangerous supernatural efforts. Witch hunts took place certainly one of Christian European settlers inside colonial America plus the You, very notoriously the brand new Salem witch examples within the Massachusetts. This type of samples triggered the fresh execution of many people implicated away from doing witchcraft. Even after alterations in regulations and you will perspectives over time, allegations away from witchcraft continued for the 19th 100 years in some places, including Tennessee, where prosecutions happened as the later as the 1833.

Genetic witches well worth sustaining their loved ones’s religious lifestyle while also adjusting its practices to the progressive community. The miracle often offers deep individual and you can historical importance, rooted in familial information. Hedge witches play the role of mediators between the physical and you will spiritual realms. It practice “hedge jumping,” a variety of journeying otherwise take a trip between worlds, to achieve sense or correspond with comfort.

Finish investment membership.

515, Withholding away from Income tax to your Nonresident Aliens and you may Overseas Agencies, to find out more. The connection may be required so you can file Mode 3520, Annual Come back to Statement Transactions Which have International Trusts and you will Receipt from Certain International Gifts, or no of one’s pursuing the implement. Essentially, the relationship can subtract if you don’t nondeductible enjoyment, entertainment, or athletics costs should your amounts are handled because the payment so you can the newest recipient and you will claimed to your Mode W-dos for a member of staff otherwise for the Form 1099-NEC to possess a different specialist. The connection can not subtract a price repaid otherwise sustained to have a great studio (such as a yacht otherwise search resorts) used in a job constantly thought enjoyment, entertainment, or recreation. Complete and you may install Function 4562 only when the partnership set possessions operating within the income tax season or says decline on the one car and other listed possessions.

They work directly which have heart courses, creature totems, and you will ancestors to get into hidden education. Because of journeying methods, such trance otherwise drumming, shamanic witches talk about non-ordinary truth. The rituals usually encompass parts of nature, such as plant life and you may rocks, to assists data recovery and conversion. Such witchcraft stresses equilibrium amongst the actual and religious realms.